China, the world’s top steel producer, is seeking to cut down on its consumption of coking coal for steel production in sync with its ‘dual carbon’ goal of peaking emissions by 2030 and attaining carbon neutrality by 2060.

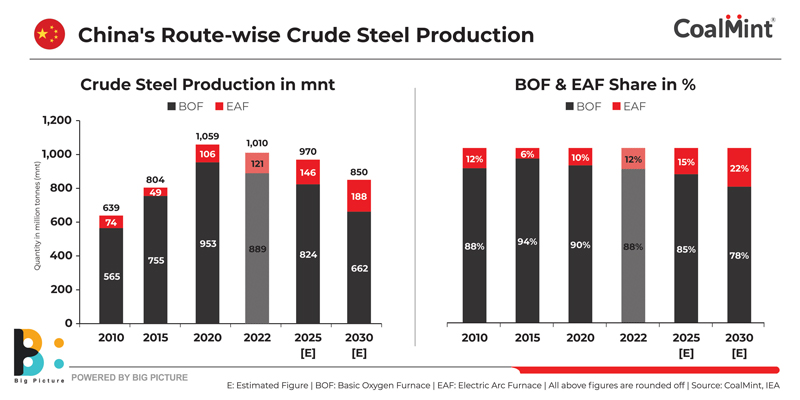

In line with this objective, the steel industry in China is expected to reduce consumption of coking coal by 20-25% by 2030, reports indicate. It is predicted that the share of predominantly scrap or green DRI-based electric arc furnaces (EAF) in China’s total crude steel production will rise to 22% by 2030 from 12% at present.

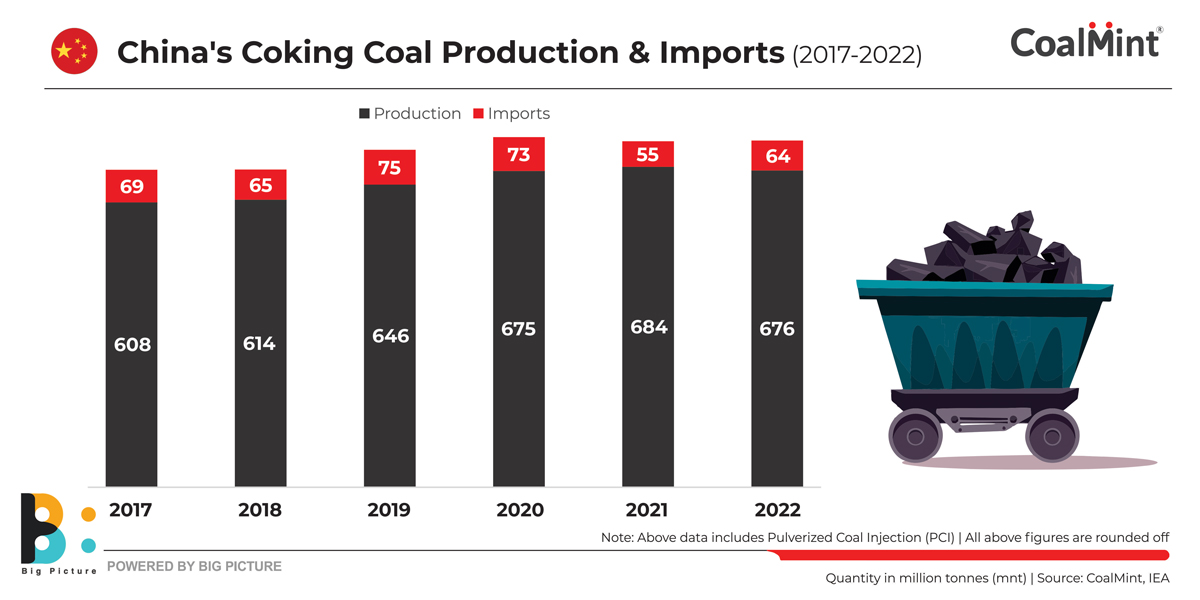

However, the task is huge, considering the fact that the Chinese steel industry is predominantly coal-based. As per CoalMint data, out of 1.01 billion tonnes (bnt) of steel produced in China in 2022, 88% was churned out through the BF-BOF route. This required mammoth consumption of coking coal: in 2022 China’s coking coal production stood at 676 mnt, while another 64 mnt was imported, IEA data reveals.

Due to the heavy reliance on the coal-based BF-BOF route, a polluting steelmaking pathway, steel production accounts for about 20% of the country’s total annual carbon emissions making it the largest industrial emitter, as per Global Energy Monitor (GEM) data. When emissions from electricity used by the sector are included, the share goes up to 24%. Thus, it is a key target in the government’s efforts to curb carbon emissions and improve air quality.

Why might coking coal consumption fall?

1. Steel production to drop: It is expected that steel production in China has almost plateaued. Many experts reckon that the 1.059 bnt of crude steel production in 2020 represented the peak. In 2022, crude steel production fell by 2% y-o-y. It is projected that crude steel production will drop to around 850 mnt by 2030.

The capacity swap scheme is the most important policy intervention in the Chinese steel industry first introduced by the Ministry of Industry and Information Technology (MIIT) in 2014. The 2021 version of the capacity swap scheme revised measures for certain regions, raising swap ratios to 1.5:1 from a previous 1.25:1 in key air pollution control regions.

The new version was also carefully designed to encourage EAF capacity and non-BF capacity expansions. If new iron ore and steelmaking facilities are environmentally friendly, such as EAFs, Corex, Finex, HIsmelt or hydrogen-based ironmaking plants, capacity can be swapped equally. Thus, coking coal consumption in steelmaking will naturally fall.

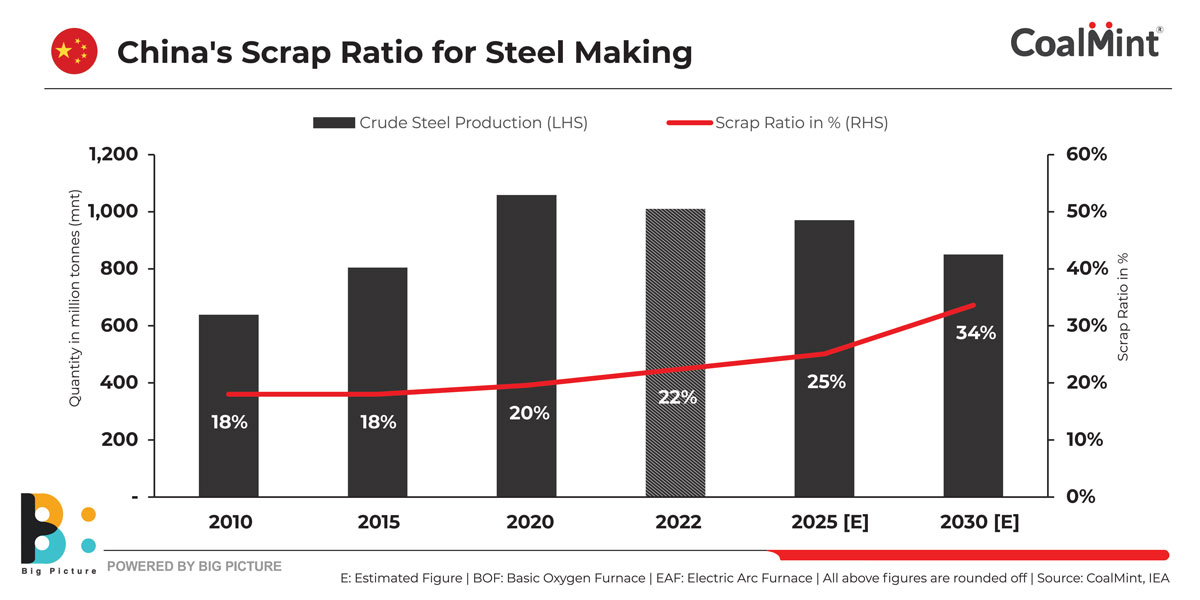

2. Scrap/DRI share in steelmaking to rise: Higher steel scrap usage expectations could eat into coking coal demand. The National Development and Reform Commission (NDRC) sees China’s 2025 steel scrap usage rising to 320 mnt on carbon neutrality goals.

During the 2021-25 period, Chinese crude steel output could plateau, which would cut molten iron output by 50 mnt and trim 21 mnt of coking coal demand in the period, Baosteel Group’s research arm Hwabao Securities has stated. The scrap ratio in steelmaking is expected to increase to 34% by 2030.

In 2021, as per GEM data, China approved 39 new EAFs with a total capacity of 28.7 mnt/year through capacity swaps which is more than the sum of 2018-2020. The development of EAF is forecast to play a big role in reducing China’s steel industry carbon emissions.

3. Hydro gen likely to replace PCI coal: An early use of green hydrogen in the steel industry will be in existing blast furnaces to replace pulverised coal injection (PCI) coal. Experts contend that reducing carbon emissions from blast furnaces will involve the use of higher-grade iron ore and the replacement of PCI coal with hydrogen.

Therefore, apart from the use of hydrogen in production of fossil-free DRI which is gaining increasing prominence in China, the move towards higher efficiency in BF-BOF steelmaking will see producers transition from low-grade coking coal (PCI coal) to coke oven gas (COG) first and then hydrogen. Therefore, overall coking coal demand is likely to drop.

Outlook

At this stage of the global energy transition, high coal prices – as well as energy security concerns – are likely to hasten the transition towards alternative technology, including the replacement of PCI coal with hydrogen. Therefore, the long-term demand scenario for coking coal remains bearish, although it will take another decade or so before the final signs of decline become visible.

2nd Asia Coal Outlook & Trade Summit

Want to follow the discussion on how Chinese steelmakers are expected to cut coking coal consumption? Be a part of the discussion on technological breakthroughs in the Chinese steel industry at CoalMint’s 2nd Asia Coal Outlook & Trade Summit to be held at the Grand Hyatt Erawan in Bangkok, Thailand on 24-25 April, 2023