Neelachal Ispat Nigam Ltd (NINL), a public sector steel entity and largest merchant supplier of steel grade pig iron, is battling raw material crisis on financial issues.

Sources privy to the development said, NINL is battling hard to buy iron ore on its own to feed the plant after MMTC, its lead promoter, stopped supplying the raw material. According to an arrangement, MMTC buys iron ore from the open market to feed the NINL plant at Kalinganagar (Odisha) and also sells the finished products manufactured at the plant. For all buying and sales transactions, MMTC is entitled to a commission of 3%.

Stakeholders abandoning sinking ship

The actual reasons for MMTC’s breaking off this arrangement are not known. MMTC, however, has informed the Bombay Stock Exchange (BSE) in a filing last month on its intent to divest its stake in the loss- making PSU. The Odisha government entities, OMC and IPICOL, which between them hold 26% equity each in NINL, are also eager to offload their stakes. MMTC is the largest shareholder in NINL with a stake of 49.9%. Other central public sector enterprises such as NMDC Ltd, BHEL Ltd and MECON Ltd also own minority stakes in NINL but they are not risking their investments in NINL that has piled up losses over the years.

In fact, the lack of adequate capital infusion has dogged the smooth operations of the NINL plant. Market sources say the plant is not generating enough cash flow to sustain itself and this has triggered speculation of its closure.

Is JSW interested?

With NINL almost up for grabs, it remains to be observed how many steel makers in the public or private sector are keen to acquire it and turn it around.

NINL’s chequered history shows both Steel Authority of India Ltd (SAIL) and Rashtriya Ispat Nigam Ltd (RINL) have made unsuccessful bids to acquire the ailing state-level public enterprise (SLPE). Of late, JSW Steel’s name has been doing the rounds.

INR 1,700 cr capital infusion needed

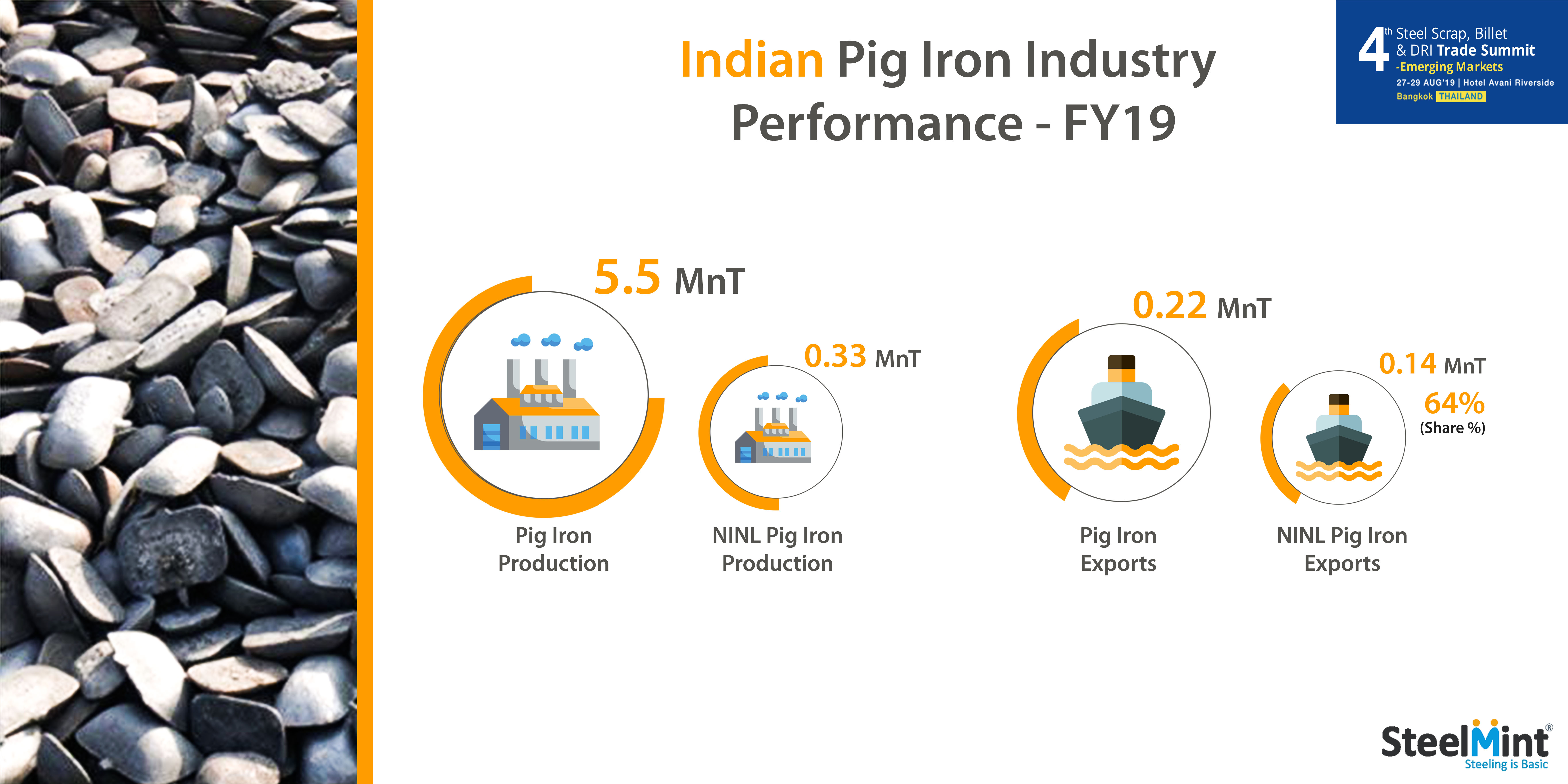

The closure of the NINL facility is bound to throw the pig iron market into a tizzy since the steel PSU is the largest merchant producer of steel-grade pig iron, with an annual production of 800,000 MT.

A source close to the development said NINL needs INR 1,700 crore of capital infusion to turn around its operations. But how can the PSU raise the sum when its own major promoters are actively pursuing plans to offload their stakes? And, the stressed, leveraged balance sheet of NINL automatically makes it ineligible to avail formal credit from a bank or financial institution.

For the past five years in a row, NINL has been stacking up losses. Last fiscal too, it ended in the red despite turning its earnings before interest, taxes, depreciation and amortisation (EBITDA) positive following the successful completion of its blast furnace capital repair work and resuming of steel billets production.

NINL is among the 200 state-level public enterprises accumulating losses. Their cases are being considered for divestment by the Union government. CPSEs that have historical investments poured into such loss-incurring firms will now have the autonomy to offload stakes.

To know more on Pig iron trade dynamics, book your seat at SteelMint’s 4th Steel Scrap, Billet & DRI Summit. The conference is being organized during 27-29’th Aug’19 in Bangkok, Thailand