Bangladesh steel industry is currently growing at a staggering rate, primarily due to the rising steel demand in the country on account of several large infrastructural projects in the pipeline for this decade. Presently there are several expansion plans underway by various steel manufacturers across the country, to meet the rising steel demand.

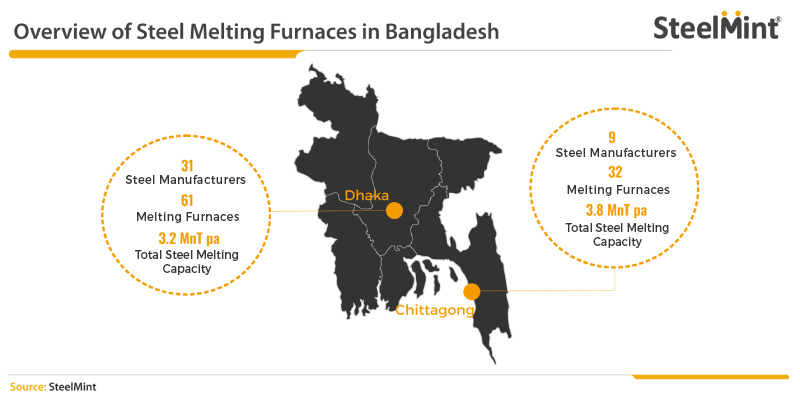

At present, there are around 97 steel melting furnaces being operated by 42 steel manufacturing companies located mostly in Dhaka and Chittagong regions. Out of 97 furnaces, 94 are induction based furnace and 3 are electric arc furnace.

Chittagong – home to large steel mills – The Chittagong region primarily houses the larger mills including the top 4 steelmakers of the country, and includes 9 steel manufacturers operating a total of 32 melting furnaces (29 IFs and 3 EAFs) with total annual crude steel capacity of around 3.8 MnT (before GPH Ispat’s new plant’s commencement). The Dhaka region on the other hand comprises of 31 relatively smaller mills operating 61 Induction furnaces with a total melting capacity of around 3.2 MnT per annum, while another 4 induction furnaces are operated by steelmaker in Comilla region.

Bangladesh steel production to increase by 1-1.5 MnT in 2020: Ongoing expansion in steel melting capacities by existing players will ensure an increment of 1-1.5 MnT of crude steel production in 2020. Recently, GPH Ispat has commissioned its 80 MT (0.86 MnT annual capacity) Quantum EAF and started trial production. Another 8-10 Induction furnaces of around 20 MT capacity each are expected to be commissioned in the next 12 months (this translates to 0.6 MnT capacity per year).

Bangladesh scrap imports likely to grow over 15% in 2020 – The rising capacities and steel production levels in Bangladesh is expected to ensure a continued growth in imported scrap volumes in coming years. The annual imported scrap volume (bulk & containers) has shown a sharp rise in recent years and were recorded at 3.6-3.65 MnT in CY 2019. The same is expected to cross 4.2 MnT by end of 2020, with the import volume having a chance to cross the 5 MnT per year mark by 2021 end, given the similar growth rate in production persists.

Similarly, DRI imports to Bangladesh will also actively increase, in line with the increasing steel production rates. Sponge Iron export from India to Bangladesh may cross 700,000 MT/year mark by 2021 end, from 461,256 MT of exports recorded in CY 2019.

To know more on the upcoming capacity expansions in the Bangladesh steel industry and its effect on the raw material import dynamics, book your seat at SteelMint’s 3rd Steel and Raw Material Conference, Bangladesh and get a chance to hear views of renowned industry participants from across the globe. The conference is being organized on 23rd-24th March 2020 in Chittagong, Bangladesh.