In its Q1 2019 earnings call held recently, US-based Graphite Electrode (GE) major GrafTech highlighted the company’s sales and financial performance, market prospects in the short term and the likely risk emerging from the upcoming Chinese GE additions. Listed below are the key points revealed by GrafTech’s top management:

A majority of Chinese manufacturers are still new in the UHP GE business:

Asked about the potential risk from the rising GE capacities in China, GrafTech’s top management highlighted that China is adding to its GE capacity massively because with 10% EAF capacity in that country almost 100 MnT of crude steel is being produced by the EAF route. The nation is planning to expand EAF capacity to 20% by 2021, which signifies the addition of another 75 to 100 MnT (equal to the entire US arc furnace industry) of crude steel to existing capacity. In order to service such a huge magnitude of EAF capacity, the country would obviously require GE capacity additions.

As regards UHP grade GEs, GrafTech’s top management said a couple of Chinese producers are working for years to produce UHP electrodes and during the shortage last year, customers selectively bought Chinese UHP grade GE on a trial basis. However, it has taken years for a couple of well-established Chinese producers to reach a point from where they can produce UHP grade GEs with a consumption and breakage rate that steel producers would prefer to try. UHP electrodes are used in high-intensity applications and high-production melt shops.

Thus, barring a few, a majority of new GE capacity additions that are claiming to be UHP grade don’t have the experience of producing high-grade GEs. It is unclear how much new capacity is being added to bolster UHP grade production and how long it will take to build and run UHP grade GE plants.

Availability of good quality needle coke still a big hurdle:

Asked about the availability of petroleum-based needle coke required to produce high-grade GEs, GrafTech highlighted that producing high-grade petroleum-based needle coke is not easy and it takes years to develop the process and secure specific decant oil supplies. Decant oil, used to produce needle coke, is a secondary product, basically a leftover at the bottom of the barrel during the oil refining process. As refineries have different operations, the quality of decant oil varies widely from refinery to refinery. So it is difficult to secure decant oil with those properties that are required for petroleum needle coke, which, in turn, is required to manufacture high-grade electrodes used in high-intensity melt shops.

Demand for needle coke from China’s EV segment:

Top GrafTech executives pointed out that China has a burgeoning requirement of needle coke from the expanding electric vehicles segment. In order to manufacture efficient battery with long life, premium quality petroleum-based needle coke is required. The Chinese still mix different products, including petroleum needle coke and pitch needle coke as well as natural graphite. This is because it’s all about the ability for the product to transfer a charge in the most effective and efficient way. Thus, the Chinese GE industry will face competition from the domestic battery industry which could well prove to be a deterrent to high-grade electrodes production in the future.

BOX

Snapshots of GrafTech’s Q1 CY19 Performance

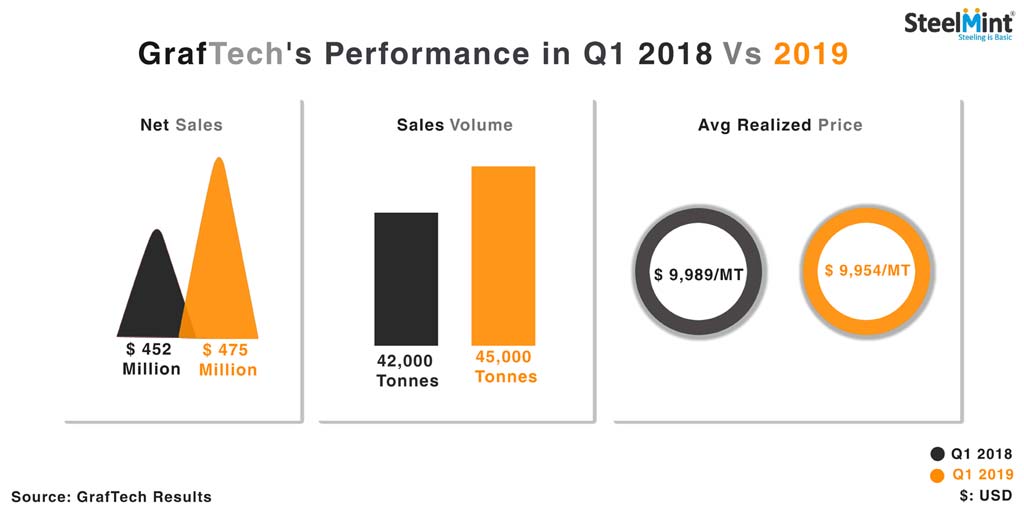

- Net sales rise by 5% Y-o-Y from USD 452 million in Q1 2018 to USD 475 million in Q1 2019

- Company registers an increase in sales from 42,000 tonne in Q1 18 to 45,000 tonne in Q1 CY19

- Average realised price from sale in Q1 CY19 recorded at USD 9,954/MT against USD 9,989/MT in Q1 2018

- GE major plans to sell majority of volumes on long term (3-5 years), take-or-pay, fixed price or volume contracts

- Company has entered into long-term agreements with more than 100 customers for 675,000 tonne at an average contract price of USD 9,800/MT for 2018-2023.

- GraftTech’s ‘Take-or-Pay’ agreements are estimated to reduce from 148,000 tonne (as of 31 Mar’19) to 120,000 tonne in 2022 with average price to plunge from USD 9,800 in 2019 to USD 9,700/MT in 2022.

- Company plans to focus on operational improvements with capital expenditure of USD 60-70 million in 2019.