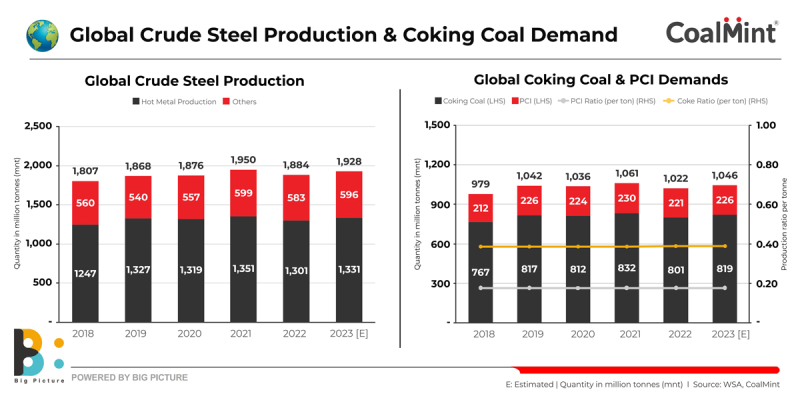

Global demand for coking coal in steelmaking is expected to increase by around 2.25% y-o-y in 2023. World Steel Association’s (WSA) short-range outlook published in April this year predicts that world crude steel production is expected to increase by 2.3% in 2023 from 1.88 billion tonnes (bnt) last year to 1.92 bnt.

Therefore, CoalMint estimates that global coking coal demand is likely to reach around 819 million tonnes (mnt) this year from roughly 800 mnt in 2022. Data reveals that global coking coal demand (excluding PCI) has grown nearly 7% since 2018.

WSA data shows that the share of oxygen steelmaking (BF-BOF) in global crude steel production was over 71% in 2022, with the rest being accounted for by the electric route (predominantly EAFs and also IFs). Therefore, global hot metal production in blast furnaces is expected to be around 1,331 mnt (1.331 bnt) in 2023–an increase of over 2% on the year from 1.301 bnt in 2022.

Demand for PCI

Notably, total coking coal demand must also include pulverised coal injection (PCI) used in blast furnaces to accelerate the process of reduction. Demand for PCI coal is likely to inch up to 226 mnt in 2023 from 221 mnt last year. So, total global consumption of coking coal + PCI may rise to 1.04 bnt this year from 1.02 bnt in 2022, as per CoalMint estimates.

Estimates further show that while the average usage of metallurgical coke in blast furnaces is at the rate of 390 kg per tonne of hot metal, the PCI rate per tonne of hot metal is 180 kg. These figures represent the global average. However, many companies have increased PCI use in the BF by as much as 250 kg per tonne of hot metal and this is mainly a cost-cutting measure. Roughly, 1 tonne of PCI replaces 1 tonne of coke and 1.5 tonne of coking coal is required to produce 1 tonne of coke.

Trade & price outlook

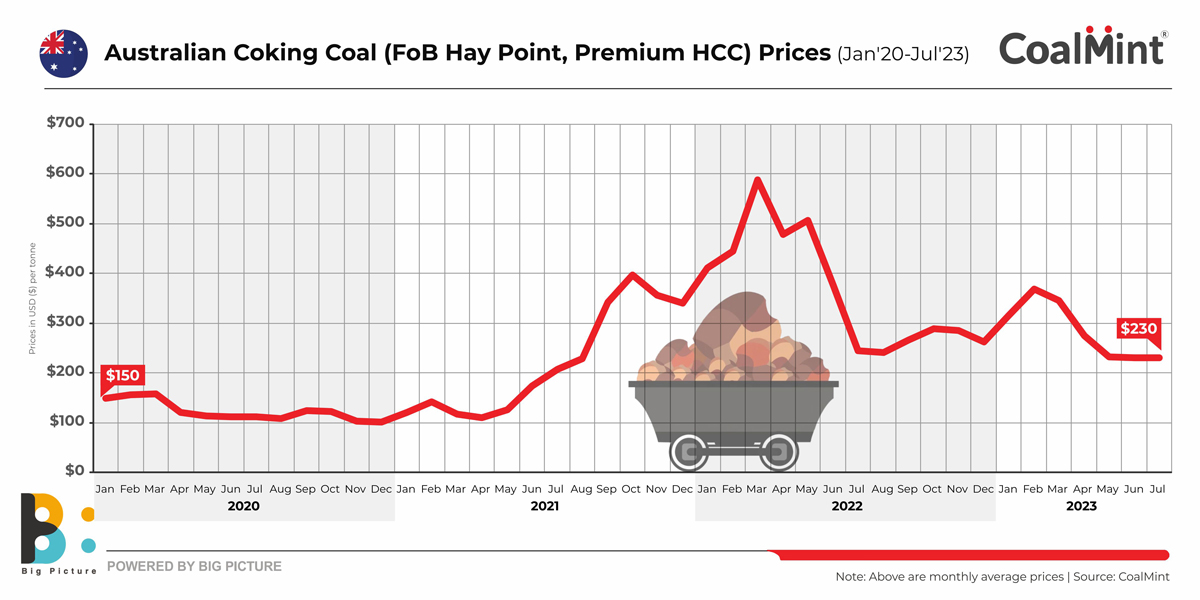

Australian premium coking coal prices have decreased to $230/t FOB from $300/t in mid-March 2023. Global inflation, monetary tightening, energy market volatility have impacted the steel market adversely. Below are factors which may impact prices in H2CY’23:

The extent of steel production curbs in China in H2 weighs on market sentiments and also obviously on coking coal demand. China accounts for roughly 56% of global steel production and 18% of seaborne coking coal demand. It is also the biggest spot market for met coal. Australian government sources predict that China’s imports of seaborne coking coal may drop 20% y-o-y in 2023.

Steel production in India rose over 8% y-o-y in Q1FY’24, as per JPC data. Steel demand is expected to increase by over 7% this year and production is likely to grow by over 10%. Commissioning of new blast furnace mills is surely positive news for coking coal demand. Sources are of the view that prices should revolve between $225-245/t FOB in H2.

According to the Australian government’s Department of Industry, Science and Resources, almost 15 mnt of blast furnace capacity has come back online again in Europe, as the continent has been able to effectively battle energy inflation. So, coking coal demand will remain largely stable in H2.

Weakening global steel market sentiment and its impact on exports weigh on the Japanese and South Korean steel industries. The two countries have a combined share of 27% of global seaborne imports. The recovery in manufacturing and automotive supply chains is an upside; however, demand outlook is largely stable.

Higher supplies are expected to weigh on prices in H2. Australia is ramping up shipments with the end of the La Nina climate episode. Supply outlook from the US and Canada is largely unchanged barring some disruptions in the US. Russia has diverted a portion of its cargoes to Asia, while Mongolia is looking to increase supplies with the laying of new railway networks.

Thermal coal prices have fallen sharply and the incentive to sell coking coal in the thermal coal market is lacking currently unlike last year. So, supplies will increase further and exert pressure on prices.

3rd India Coal Outlook Conference

Hear experts deliberate on ‘Global metallurgical coal & coke market trends: Will supply concerns intensify?’ at SteelMint Events’ 3rd India Coal Outlook Conference to be held at JW Marriott, Kolkata, from 24-26 August 2023. Register now.