- Eased LC issues help Bangladesh secure vessels

- Prices of both containers, tankers fall y-o-y

- Indian prices may increase amid scant inventory

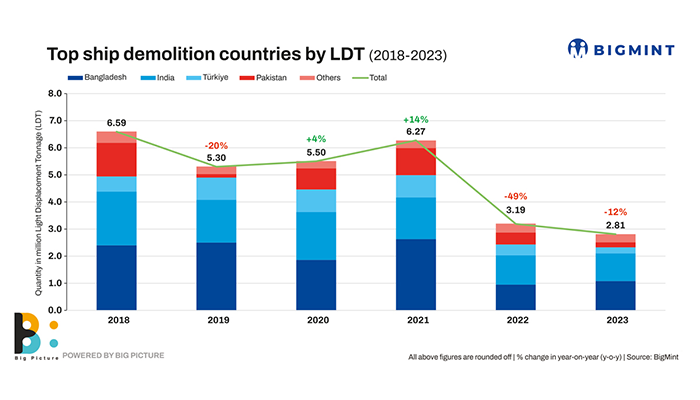

Morning Brief: The global ship-breaking market remained in deep waters in 2023. Total tonnage sunk 13% to 2.8 million light displacement tonnage (LDT) compared to 3.2 million LDT recorded in 2022.

Bangladesh had snatched back its position as the largest ship-breaker globally in terms of tonnage earlier last year from India and retained it till the end. It concluded the year with total tonnage rising over 20% to 1.10 million LDT against 0.9 million LDT in 2022. It also led in terms of vessels demolished, at 138 units compared to 128 in 2022, up 39% y-o-y.

India, on the other hand, slipped 9% to 0.9 million LDT (1.1 million LDT). However, the number of ships demolished rose a modest 8% to 138 from 128 in 2022.

Pakistan and Turkiye have been neck-and-neck since 2022. Demolition tonnage fell 50% last year for both to 0.02 million LDT from 0.04 million LDT in 2022. Both saw a drop in the number of vessels recycled but Pakistan’s plunged 65% to a mere 15 while Turkiye experienced a modest 8% drop to 44 (48 in 2022).

Bangladesh, India, and Pakistan set benchmarks as they traditionally command the lion’s share of the global ship recycling market — last year’s was over 80%.

Price remain underwater y-o-y

Demolition scrap prices fell y-o-y but Bangladesh still managed to remain slightly more supported than the other two.

For instance, container prices in Bangladesh dropped the least, by 6%, to $579/LDT in 2023 against $616/LDT in the previous calendar.

Pakistan’s container prices crashed by 8% to $550/LDT ($601/LDT) while India’s fell 7% to $565/LDT ($606/LDT) in this period.

Tanker prices showed a deeper drop. As in containers, in tankers too, Bangladesh weathered the storm better than the others, with its recycled rates falling 7% to $561/LDT last year compared to $600/LDT in 2022.

In Pakistan, the fall was the sharpest, by 10%, to $533/LDT ($590/LDT). India saw a drop of 8% to $546/LDT ($591/LDT).

Factors impacting ship recycling market in CY’23

Bangladesh recyclers swim against the tide: Despite the challenges of inflation and a sliding currency, Bangladesh ship recyclers managed to keep their head above the water thanks to a few reasons. One, in early 2023, the country secured a substantial $4.7-billion IMF loan, which bolstered its foreign exchange reserves and helped it open letters of credit (LCs) to secure the much-needed tonnage. In 2023, Bangladesh’s foreign exchange reserves stood at $17.20 billion, falling slightly short of the relaxed minimum target of $17.78 billion. But its recycled ship buyers bid aggressively, upping the competition heat with Indian counterparts. This is essentially because, unlike India, Bangladesh mills are entirely dependent on imported scrap and are willing to pay more to secure the raw material. Thus, average prices of containers and tankers were higher compared to that of India and Pakistan, although these were lower y-o-y. It was also heard that smaller, cost-effective vessels lured buyers.

Secondly, although LC openings hit record lows in 2023 because of the falling forex reserves, later in the year the government eased rules, benefitting ship-breakers. Because of the higher prices offered, more ships diverted towards Bangladesh, especially from the Far East due to the geographical proximity and lower delivery costs involved.

Thirdly, tonnage improved amid an increase in recycling yards(PDF). The country got its first green shipyard, PHP Ship Breaking and Recycling Industries Limited, in 2017. Following a four-year gap, three more — SN Corporation, Khwaja Ship Breaking, and Kabir Steel –received the green yard nod. Currently, there are four green yards (among the total 20-25), which are officially recognised as meeting the environmental standards set by the Hong Kong International Convention (HKC).

Challenges rock the Indian boat: The Indian recyclers swam in choppy waters, particularly in Alang, and not without reason. First, the region faced increased competition as it took on additional recycling activities from competing sub-continental markets, leading to strain on resources and facilities. This surge in activity put pressure on prices for ship owners and cash buyers, reflecting oversupply and intense competition among yards. Secondly, the slight fluctuations in the Indian rupee added to uncertainty and disparity in pricing. Thirdly, regulatory hurdles came in the way. For instance, the UAE ruling, banning its own flagged vessels from’beaching’ in India, further disrupted the flow to Alang. Fourth, a shortage of tonnage hindered operations and contributed to fluctuations in local plate prices. Alang witnessed the lowest tonnage in the last 10-12 years, at around 23,000 LDT.

The market experienced a lacklustre start in 2024, possibly due to the challenges overhang from the previous year, with some transactions being redirected to Pakistani buyers, indicating a shift in market dynamics. Overall, the Alang market witnessed subdued activity characterised by decreased demand in both the plates and scrap segments amid competing raw materials like sponge iron etc.

Pakistan unable to make waves: As the third-largest ship recycling country, Pakistan has been finding it increasingly hard to attract sellers. After a prolonged 6-7-month period of inactivity (February-August), caused by severe currency problems, political unrest, and economic crises, buyers re-entered and surpassed India and Bangladesh in average vessel prices in August and also saw some sales. This swift market shift resulted from improved local sentiments and issuance of LC approvals for specific individuals. However, in October, the tonnage again dropped on weaker buyer sentiments amid the ongoing economic crisis. In the initial 10 months of 2023, domestic ship-breaking scrap prices experienced significant volatility, fluctuating between PKR 165,000- 200,000/t because of the PKR’s devaluation, demand from other competing markets, challenges in opening LCs, and scarcity of available vessels for recycling. The ratio of melting scrap to rerolling scrap from vessels is 20:80, underscoring the need for ship-breaking scrap.

Outlook

In Bangladesh, seven additional green yards are under process in 2024, which will increase tonnage in the near future. Green ship-yards can attract more customers and generate higher profits.

In India, prices are not likely to go down from current levels and can, instead, increase as there are few vessels left for demolition amid scant inventories.

But, overall, with countries adopting stricter carbon emission norms, ship-recycled scrap usage will increase, going forward, in comparison to sponge iron.

4th Bangladesh International Trade Summit

Bangladesh, a strategically significant country for Asia-Pacific, is emerging as a hotspot of growth through sustainable practices. The economic expansion is expected to encourage the participation of more global companies and attract forex for the country.

BigMint Events will be hosting the 4th Bangladesh International Trade Summit on 14-15 May 2024, at Hotel Pan Pacific Sonargaon, Dhaka, Bangladesh. The two-day conference shall bring together key stakeholders from the steel, cement, and power industries, including industry stalwarts, policymakers, traders, and investors. It shall provide a network for collaboration and an ideal platform for discussion of prevailing industry trends and challenges.