Gold Sponsors

Silver Sponsors

Associate Silver Sponsors

India Coal Outlook Conference 2022

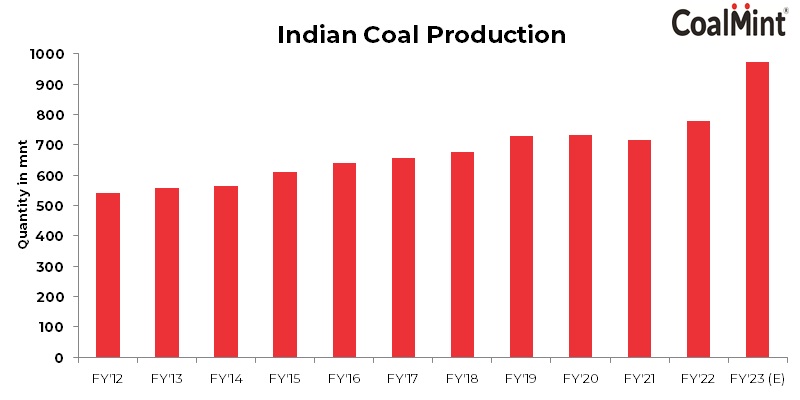

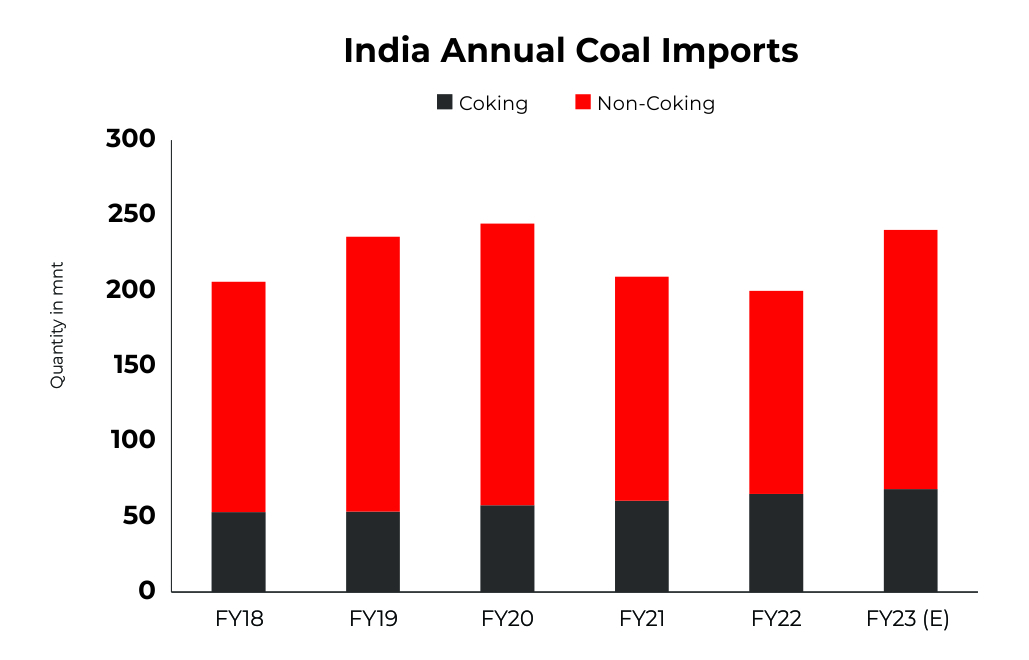

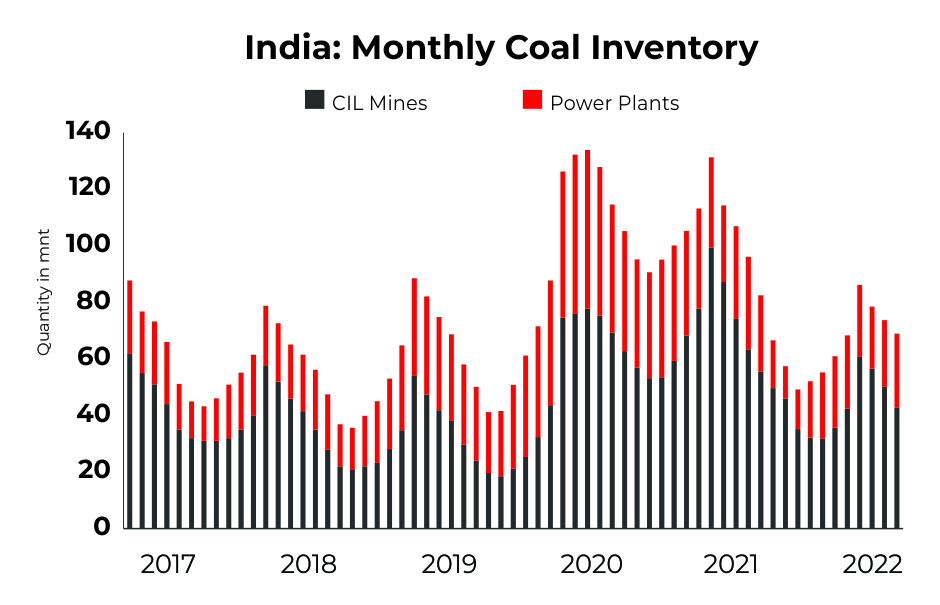

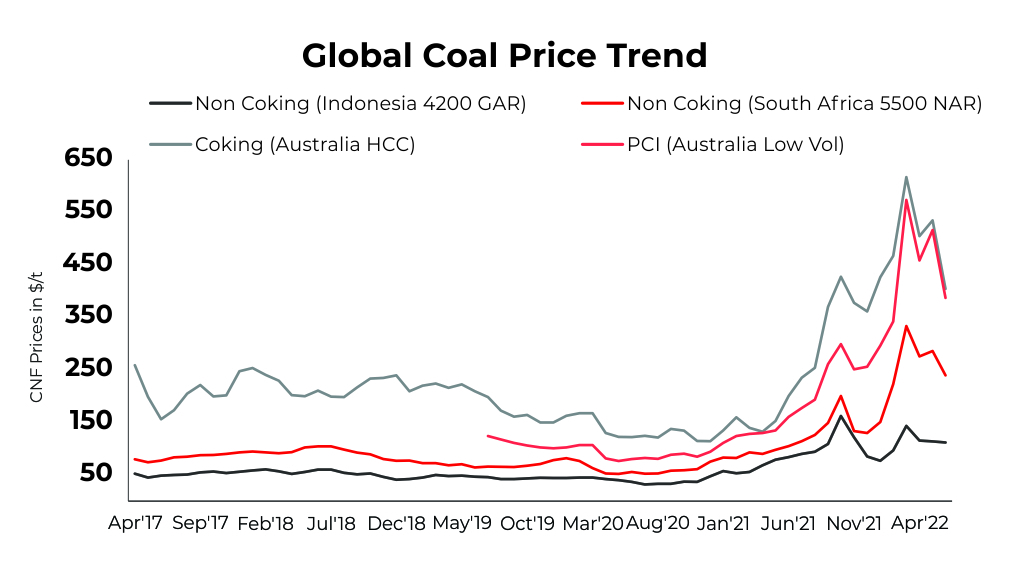

Supply shortfall from major exporting geographies, geopolitical turmoil and sanctions and the unprecedented surge in prices have roiled the global coal market. In India, despite the government’s pledge to cut down imports, domestic supply squeeze have pushed key industries to the brink forcing the government to rethink.

CoalMint’s India Coal Outlook Conference brings together on one podium stakeholders from the entire coal value chain to deliberate on the pressing issues of the day. The event will feature thought-provoking sessions on domestic end-users’ perspectives on the unfolding supply scenario, technical and logistical hurdles to raising dispatches as well as policy measures intended to address the current impasse.

Watch out for brainstorming sessions on global trade dynamics, outlook on steelmaking coal demand and investment dynamics as well as clean coal technologies and decarbonisation challenges.

What lies ahead? Where are coal prices headed? Will domestic production keep up pace with demand in 2022? How will imports pan out for the rest of the year? Find out at the India Coal Outlook Conference on 3-4 August, 2022 to be held at the Lalit, New Delhi.

Key Focus Areas

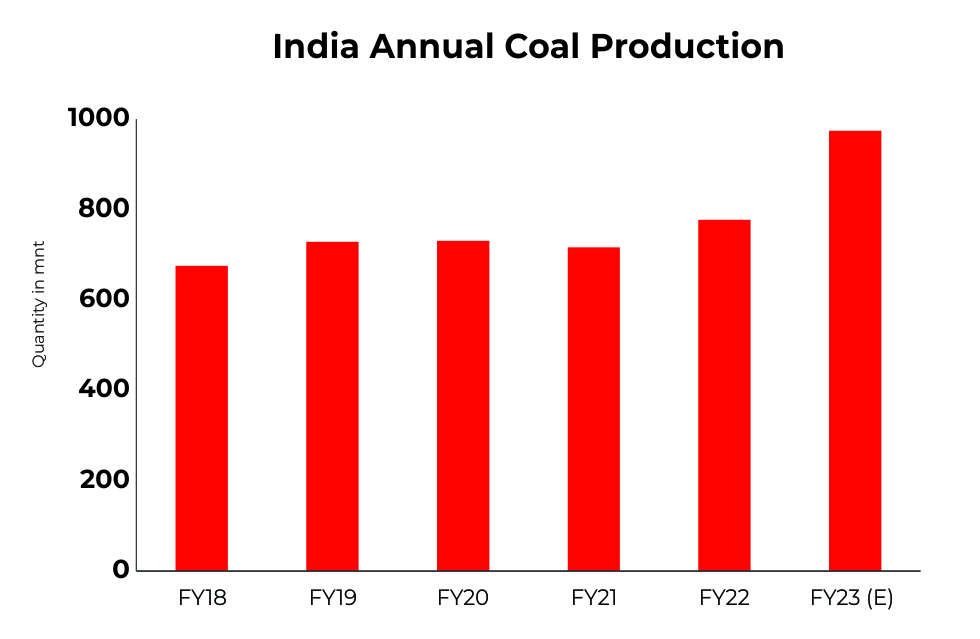

CIL production outlook

- Key note address

The Russia-Ukraine conflict, energy crisis and the road ahead

- The impact of the Russia-Ukraine crisis on global energy supply

- Sky-high prices of LNG, coal and oil

- CIL’s techno-economic efficiency measures to boost production

- Global net-zero target, renewables, and increasing reliance on coal

- Optimising energy efficiency at power utilities

The Indian coal market scenario, rising raw material costs, insufficient domestic supply

- Annual/daily sectoral coal consumption per tonne/kWh of production

- Share of domestic/imported coal in total annual consumption

- Rise in imported coal prices

- Domestic availability concerns

- Share of coal in total cost of production

- Current margins, technical issues – availability of specific grades, etc.

India’s rising power demand, supply challenges and possible solutions

- CIL’s 700 million tonnes per annum production target

- Sharp rise in auctions premiums

- Rising power usage with economic recovery

- India’s renewables energy strength

- Reliance on coal-fired power genertation

- Solutions on curbing emission targets

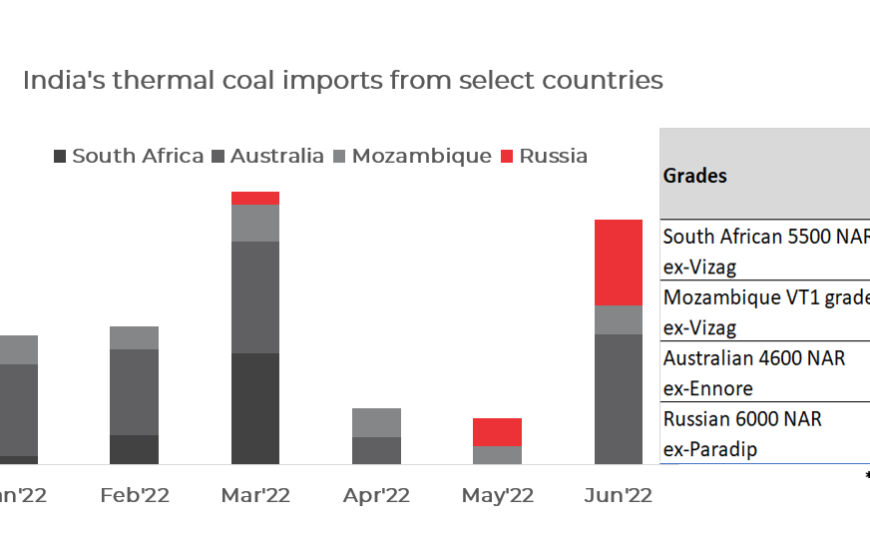

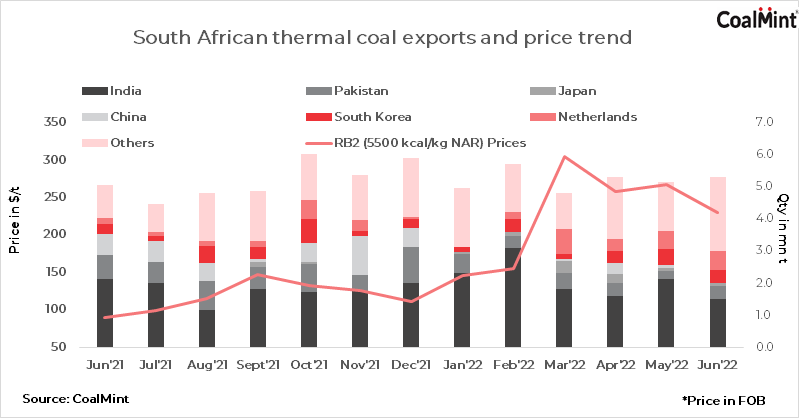

Global thermal coal trade dynamics post-sanctions on Russia

- High global energy prices and the impact on demand

- Supply constraints in South Africa, Indonesia, Australia

- China’s imports impacting global trade

- Demand in Europe and near-term outlook

- Russian coal exports to China, India, Pakistan

How are railways addressing the coal logistics challenges in India?

- Challenges of coal delivery via railways

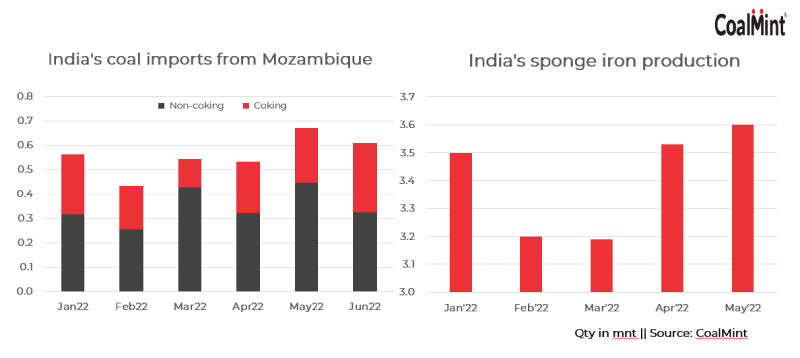

Key Note: Is India’s Coking Coal demand set to double by 2025?

Pricing power for Indian coal importers, need for an index?

- India as leading seaborne met coal consumer

- Lack of pricing power with Indian importers/steel majors

- Steel production curbs in China, China’s domestic coking coal supply scenario

- Are global majors undertaking a shift away from coking coal? Deliberations on global investment scenario

Factors driving global coking coal prices, how long will it sustain?

- Elevated global coking coal prices this year

- Supply challenges amid Russia-Ukraine war, adverse weather conditions in Australia

- Are coking coal supplies likely to freeze with increasing de-carbonization, ESG compliance?

Steel production mid-term outlook in India

- BF production outlook short-to-mid term

- Share of BF production in India’s total steel output to rise?

- BF capacity expansion in pipeline

Presentation/Panel – Changing global trade dynamics of metallurgical coke market

- China’s domestic demand and coke export outlook

- Japan’s emissions concerns and curbs on exports

- India’s coke exports to pick up pace in near term?

Objectives

- What lies ahead?

- Where are coal prices headed?

- Will domestic production keep pace with demand in 2022?

- How will imports pan out for the rest of the year?

Tentative Schedule

| Day 1 | 03. 08. 2022 | |

| 08:00 – 12:00 | Registrations | |

| 5th Indian Iron Ore & Pellet Summit (Hall A) | India Coal Outlook Conference 2022 (Hall B) |

| 10:00 – 10:45 | Keynote Address | |

| 11:00 – 12:00 | Indian iron ore production & demand outlook – FY’25 | 11:00 – 12:00 | Pricing Power for Indian coal importers, need for an index? |

| 12:00 – 12:20 | Tea & Refreshments | Networking | |

| 12:30 – 13:00 | Iron ore beneficiation policy in India – Updates & way forward | 12:30 – 13:00 | Factors driving global coking coal prices. How long will it sustain? |

| 13:30 – 15:00 | Lunch | Networking | |

| 15:00 – 16:00 | India’s steel demand & production outlook – 2030 | |

| 16:00 – 16:45 | How are Indian mills addressing the decarbonization factor through raw material? | |

| 16:45 – 17:00 | Tea & Refreshments | Networking | |

| 17:00 – 17:40 | Post Mine Block Auction Clearances – Process & Challenges | 17:00 – 17:40 | Changing trade dynamics of metallurgical coke market |

| 18:30 – 21:00 | Dinner | Networking | |

| Day 2 | 04. 08. 2022 | |

| 10:00 – 10:40 | Keynote Address-CIL production outlook & how is Railways gearing up to address the logistical challenges | |

| 10:45 – 11:45 | Key government policies to look out for in the Indian iron ore industry | 10:45 – 11:15 | The Russia-Ukraine conflict, energy crisis & the road ahead |

| 11:45 – 12:00 | Tea & Refreshments | Networking | 11:45 – 12:00 | Tea & Refreshments | Networking |

| 12:00 – 12:30 | How will Karnataka’s Iron Ore industry shape up after Supreme Court’s order ? | 11:30 – 12:45 | India coal market scenario, rising raw material cost, supply challenges and possible solutions |

| 12:30 – 12:45 | When can we expect iron ore mining to resume in Goa ? | 12:45 – 15:00 | Lunch | Networking |

| 12:45 – 13:00 | Can we expect Maharashtra to come within the top 5 iron ore producing states in India? | |

| 13:00 – 13:15 | Rising Capacities of India iron ore concentrates | |

| 12:45 – 15:00 | Lunch | Networking | |

| 15:00 – 16:00 | Impact of Geo political factors and export duty on Indian iron ore industry | |

| Conference closure & Vote of Thanks | |

Registration Fee

| No. of Delegates | Onspot Fee / Delegate (INR) |

| 1 | 44,000 |

| 2 | 44,000 |

| 3 | 44,000 |