- Panic selling, lower offers weigh on prices

- Need-based procurement in domestic market

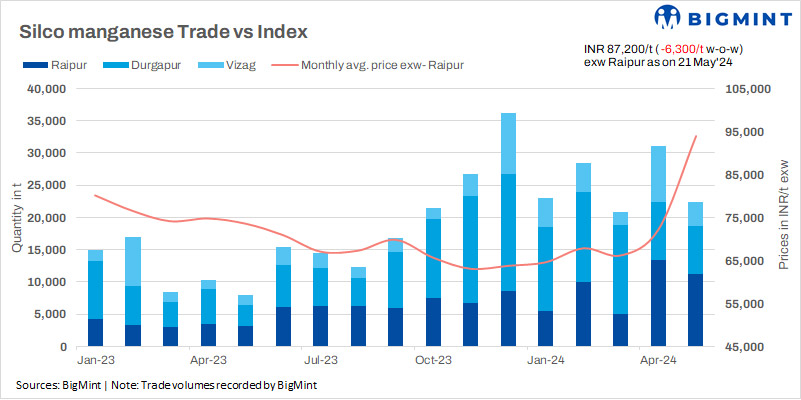

The domestic silico manganese market witnessed a counterintuitive price correction this week, exhibiting a significant downward trend that defies recent market expectations. Key producing regions in India experienced a notable price decrease on a w-o-w basis compared to the assessment ending 14 May, 2024. Prices are seen edging close to one month low, as per data maintained with BigMint.

BigMint’s assessments on 21 May revealed a substantial w-o-w decrease of INR 6,300-7,900/t ($76-$95/t) for grade 60-14 silico manganese. Prices of this grade were assessed yesterday at INR 84,000-87,200/t ($1,008-$1,048/t) exw. Notably, offers in Raipur were at INR 87,000-88,000/t ($1,045-$1,057/t) exw.

Market overview

1. Need based procurement in the domestic market: India’s steel mills procured silico manganese according to their needs. This cautious approach reflects buyers’ anticipation of further price cuts, resulting in lower purchase volumes in the immediate run. The reluctance to acquire at current rates puts additional strain on silico manganese smelters, which are already struggling in a shrinking market. In addition, lower offers from traders and panic sales on expectation of further price drop has resulted in price drop.

2. Cost-competitive offers from other regions: Manufacturers from Raigarh are offering material in the range of INR 83,000 to 84,500/t ($775), putting pressure on the Raipur domestic price. Few other merchants provided lower rates, making the players cautious to accept higher offers. However, major smelters are accepting offers ranging from INR 86,500-88,000/t ($1038-$1,055/t).

“One of the key producers from Vizag notified BigMint that we are unable to trade at INR 86,000/t exw in Vizag since competitive prices from Raigarh and Durgapur are significantly lower than the Vizag smelters’ offerings. Vizag is under pressure to lower prices due to drop in manganese alloys export prices and price drop.”

3. Fall on silico manganese export prices : The Indian silico manganese export market encounters significant headwinds due to subdued demand. Export prices have fallen by $30 per tonne compared to the previous week, reflecting a buyer’s market. Weak demand from the alloy steel sector, a key consumer of silico manganese, is pressuring prices and requiring price cuts to clear existing stockpiles. Low overall trading activity in the global market further weakens export prospects by limiting buying activity. Furthermore, port inquiries in India suggest potential for further price decreases, with inquiries at $1,090-1,110/t FOB (Vizag/Haldia). Recent deals concluded at these lower levels raise buyer expectations of a sustained downward price trend.

4. Imported manganese ore supply shortage seen easing: Prices of imported manganese ore, a crucial element in silico manganese production, remained unchanged. This stability contradicts the anticipated upward pressure on silico manganese prices due to rising raw material costs. Notably, Samancor’s joint venture plans to resume mining at South32’s GEMCO unit in June post suspending in March, aiming to build stockpiles before the 2024/2025 wet season. Recovery from March’s cyclone impacts includes dewatering and infrastructure repairs.

Outlook

India’s domestic silico manganese market faces potential price fluctuations. Weak export demand and competition from other regions could push prices down, while global miners expect higher prices to persist. Closely monitoring these conflicting factors is crucial for market participants to make informed decisions on pricing and production in this uncertain short-term environment.

Additionally, India’s domestic silico manganese market shows mixed price signals. While downward pressure exists, some smelters secured deals at INR 90,000/t exw Vizag, highlighting potential pockets of stability. Close monitoring of market activity remains crucial.

BigMint suggests monitoring the upcoming imported Mn ore weekly index, situation in Europe, the ongoing buying activity from Southeast Asia, and the performance of the domestic steel trade would be critical in predicting the future trajectory of silico manganese prices in India.