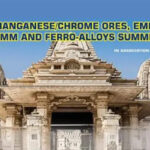

India’s iron ore consumption is slated to increase to 255-260 million tonnes (mnt) by financial year 2024-25 (FY25), as per a SteelMint forecast. In FY2019-20 (FY20), iron ore consumption was at around 185-190 mnt. This indicates that the jump in FY25 compared to FY20 would be over 35%.

India’s iron ore consumption has been steadily rising over the last decade, on the back of increased crude steel and sponge iron production. In FY15, iron ore consumption increased to around 138 mnt from 102 mnt in FY10.

Factors that will support increased iron ore consumption

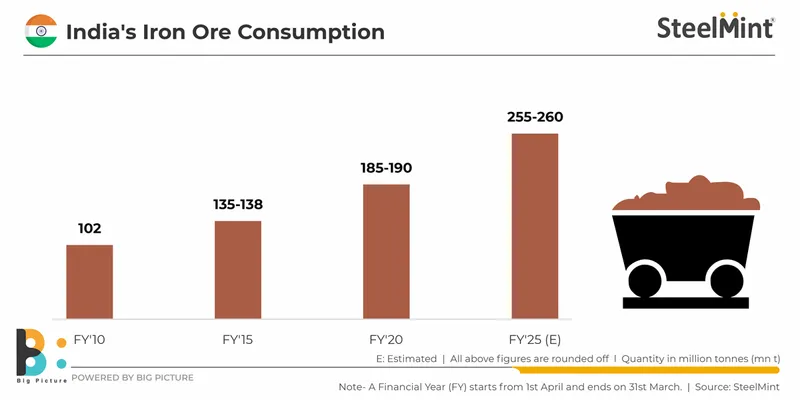

The two key drivers of iron ore demand in India will be increased hot metal and sponge iron production.

Increased steel capacity in coming years: This will come in largely in the form of hot metal production through the blast furnace route. India is the second-largest steel producer, after China. Its steel manufacturers are in various stages of capacity expansion.

Resultantly, India’s hot metal production, as estimated by SteelMint, will increase to 90 mnt by FY25 from 73 mnt in FY20.

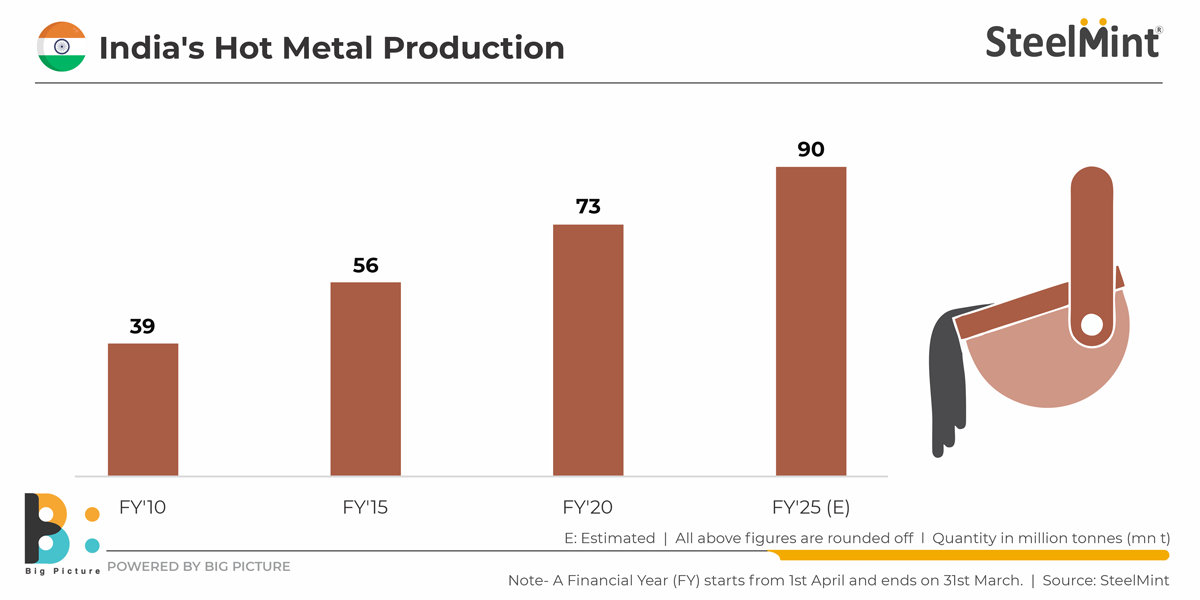

Currently, India’s installed crude steel-making capacity is at 167.22 mnt, in which the share of the BF-BOF route is 70.23 mnt (42%) and EAF/IF route is 96.99 mnt (58%). However, SteelMint estimates that by FY25, the total crude steel capacity will rise to an estimated 206.04 mnt. In this, the share of BF-BOF will rise to 96.85 mnt or 47% and EAF/IF to 109.19 mnt (a drop to 53%).

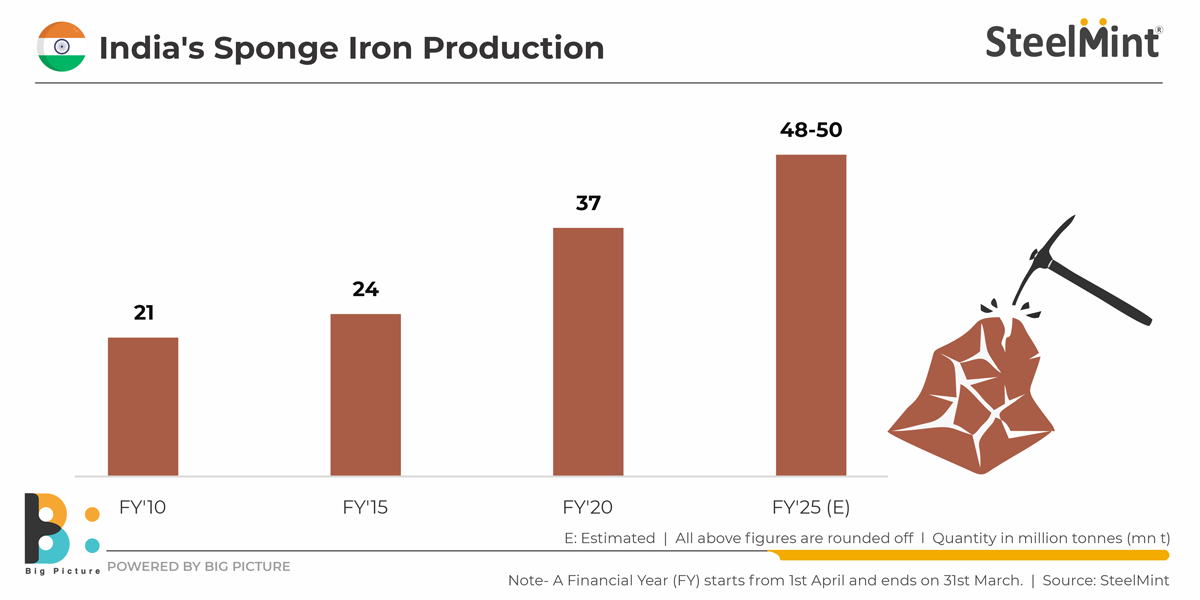

Expected increase in sponge iron production: The country’s sponge production is also expected to increase over the next few years and by FY25 touch 48-50 mnt, although the segment is experiencing short-term hiccups, in the form of high thermal coal prices etc. However, looking at the long term, production is set to increase from 37 mnt seen in FY20.

Iron ore production expansion plans

Increased consumption would entail higher production. Where will the iron ore be sourced from? To feed the growing appetite from the steel mills, major miners have chalked out expansion plans. For instance, India’s largest merchant miner, NMDC, aims to expand production to 56-58 mnt by FY25 from the current 42 mnt. OMC, the second-largest merchant miner, will increase output to 38-40 mnt from its present 27 mnt.

Reforms like dissolution of demarcations between merchant and captive blocks will allow any player (steelmaker or merchant miner) bagging a mine in future auctions to sell in the merchant market without any end-use restrictions. This will increase ore availability.

Moreover, mills will be able to sell 50% of their mined output in a year in the open market from mines won in previous auctions (prior to the policy announcement dissolving captive-merchant bifurcation). The 50% can be sold after meeting the requirement of the attached plant subject to the payment of additional amount as prescribed under the sixth schedule of the MMDR Act.

Primary steel manufacturers like SAIL, Tata Steel and JSW Steel are eyeing 38-40 mnt of iron ore production each by FY25. SAIL is currently producing 34 mnt, and Tata Steel and JSW Steel, 31 mnt each. Thus, total iron production from the five key producers may increase from the present 165 mnt to 208-218 mnt by FY25.

India’s total iron production is expected to grow to 300-310 mnt by FY’25 from 246 mnt in FY20.

Outlook

Thanks to new mining policy reforms, which aim to facilitate production, India seems well-placed to meet its iron ore demand in the next few years from domestic resources and will not be dependent on imports.

An increased number of pellet plants are in the pipeline since end-users want to avoid sinter as a feedstock. The former yields higher productivity and consumes less coal compared to sinter, which means lower carbon footprint. This will support higher iron ore consumption, going forward.

If the recently imposed export duties on iron ore and pellets remain, then overseas sales will be impacted. If the same is removed or rationalized, then exports can be expected to spring back to previous levels of 15-20 mnt per annum.