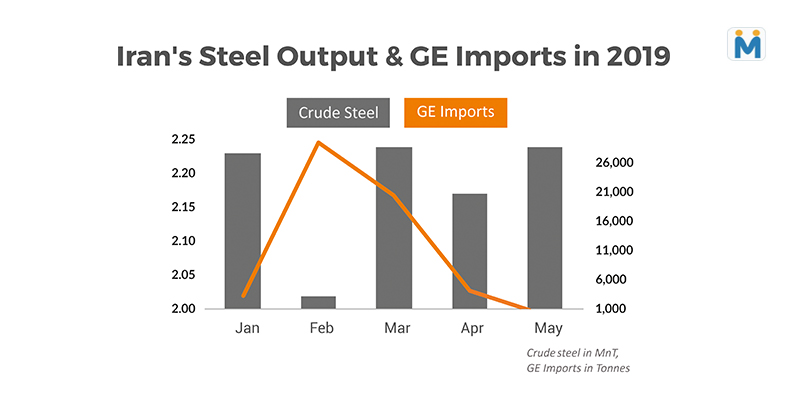

Iran’s steel industry has been growing rapidly in recent years in line with the country’s ambitious plan to raise output to 55 million tonnes per year by 2025.The country’s crude steel output in 2018 stood at around 22.8 MnT, registering a surge of 7% y-o-y basis. Also in first five months of 2019 (Jan-May), the same stands at around 10.9 MnT up by 5% against the corresponding period of previous year. The Iranian steel industry is largely based on electric arc furnace steelmaking and with growing steel production and demand, the country is facing difficulties in procuring graphite electrodes (GE) – a key raw material for EAFs amid sanctions imposed by U.S. last year.

In August 2018, U.S. had announced the first tranche of financial sanctions on Iran targeting the Iranian currency purchase and key industries after pulling out of the 2015 nuclear deal with Tehran. This restricted Iran’s purchase of U.S. dollar which is the most preferred currency to carry out the global trade.

Later on in November 2018, U.S. imposed a second round of sanctions on Iran targeting country’s oil sector where any oil trade with Iran would result in imposition of secondary sanctions on that country. And if this was not enough, in early May this year, the Trump administration imposed third round of sanctions on Iran’s metal industry including iron and steel, aimed at cutting off revenue to Iran completely. These sanctions are warning to other nations that allowing Iranian steel and other metals into their ports will attract secondary sanctions upon them also.

Subsequently, with such restrictions in place leading to GE shortage in the country, Iran that has already set up a joint venture with the local companies plans to start the trial production of the plant by March 2020. In 2017, a joint venture called Novin Electrode was set up between Iranian state mines and metals holding company Imidro, Mobarakeh Steel Co and Khorasan for the production of graphite electrodes and the total investment estimated in the same was USD 200 million.The initial plant capacity is around 30,000 tonnes which will be increased to 45,000 tonnes per year in the next phase.

How Iran is meeting its GE requirements amid sanctions?

Although before sanctions Iran was completely dependent upon imports from India and China to meet their GE requirements, post sanctions India completely stopped exporting the same to Iran. However, from Iran’s customs data it can be seen that GE is still being indirectly supplied to the country from China.

In 2018, Iran imported about 109,331 tonnes of GE against 87,480 tonnes in 2017, thus marking an increase of 25% y-o-y basis. If we analyse the country-wise imports, in 2018 GE exports from India to the Iran dropped significantly and almost became negligible post August. However, continuing its trend, China remained the top GE exporter to Iran despite sanctions and in fact during Aug-Dec’18, the country’s GE exports to Iran recorded a surge of 42% against the corresponding period of 2017.

Looking at the 2019 numbers, during Jan-Apr Iran imported about 51,618 tonnes of GE against 36,615 tonnes in the same period last year, thus registering an increase of 45% y-o-y basis. Now out of the total imports of 51,618 tonnes in first four months of ongoing year, about 85% came from China followed by UAE (8%) and Germany (4%) whereas imports from India were quite insignificant.

As per the market sources, the circumvention of U.S. sanctions is taking place by the trade participants in collusion with shipping agents in Oman and Turkey. The Chinese exporters are directing their exports to Oman or Turkey in middle-east and after altering the bill of lading where the origin of shipment is changed at the port, the same is directed to Iran thus making evasion of U.S. sanctions possible. As this trade arrangement still involves quite a lot of risk, Iran is eagerly focusing on having in-house GE production facility to have interrupted domestic steel production.